If you were to ask the average person in the street to name a betting company, there’s a fair chance they would come back to you with: “Ladbrokes” – certainly if you were to ask that question in the UK. But how did this well-known gambling company come to such prominence?

From relatively humble beginnings well over a hundred years ago, the company grew slowly but steadily to begin with. But it has now long been established as one of the dominant forces of the UK high street betting market.

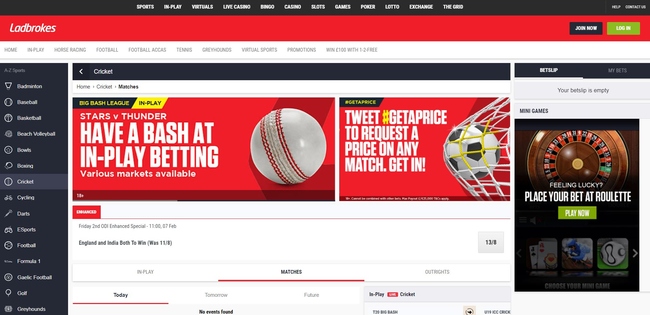

It hasn’t been all about the high-street though. Ladbrokes is a thoroughly modern betting company and certainly hasn’t been left behind during the relatively recent boom in online gambling.

Whether it’s horse racing, sports betting, poker, bingo or casino gaming which floats your boat, Ladbrokes has all bases covered, be that in the traditional bricks and mortar shops, or in the modern online and mobile betting environment.

So how exactly did the company grow from the brainchild of two gentleman way back in 1886 into the global gambling behemoth it is today? Here we take a look at the timeline of one of the betting world’s biggest success stories.

1886: Company Founded

Internet Archive Book Images [No restrictions]

The basis for the initial business model of the Scwhind and Pennington endeavor was a far cry from that employed by the company today – being predominantly based upon the training and backing of their own horses. The base for these operations being a certain Ladbroke Hall in Warwickshire.

1902: All Good Companies Need A Name

It wasn’t until 1902 that the company was first given the title which has become so synonymous with the UK betting scene, and the man to be credited with the naming of the operation was one Mr Bendir who joined the operation in 1902.

More of a bookmaker by trade than either Scwhind or Pennington, Bendir not only decided that the Ladbroke of Ladbroke Hall would make a suitable title for the fledgling firm, but he was also seen as being responsible for changing the focus of operations, as the business moved more towards laying bets rather than placing them. 1902 also marked the year when the base for the company’s operations first shifted from Warwickshire to London.

Being based in London it isn’t too surprising that the company targeted the capital city – and in particular its booming clubs such as Whites and The Carlton – for its early clientele. This approach contributed greatly to the early success of Ladbrokes, with the elite and members of the aristocracy featuring prominently amongst its’ list of customers.

1919: The First Lady of Ladbrokes

It wasn’t all about the gentleman’s clubs of London though, with the company also looking to attract custom from British racecourses.

The face of this side of the business was a lady by the name of Helen Vernet. It was relatively unusual to see a female in such a position at the time – so unusual in fact that Helen Vernet was the first ever female licenced on-course bookmaker in Britain.

Mrs Vernet was to become a part of the furniture at Ladbrokes, being made a partner in the firm in 1928, and continuing to work there until shortly before she passed away in 1956 at the age of 80.

1956: Purchased By Mark And Cyril Stein

1956 was certainly a pivotal year in the future of Ladbrokes. Not long after the death of Helen Vernet – and driven by falling business, due in part to the post-war economic climate – the decision was taken to sell the company.

The proud new owners of Ladbrokes at the time were the uncle and nephew combination of Mark and Cyril Stein. The eye-watering purchase price for the time of £100,000 would soon be looking like a very shrewd piece of business indeed.

1961: Betting Shops Legalised

This was a real watershed moment not just for Ladbrokes, but for the British betting industry as a whole. Under the Steins’ ownership and management, Ladbrokes were one of the companies to most fully recognise and realise the potential of this new development.

Opening their first betting shop in 1962, the company employed the strategy of reinvesting their returns into the acquisition of an increasing number of premises, and by 1967 had around 50 betting shops throughout Britain.

1964: Major Stake In The Dragonara Palace in Malta.

This marked the first real sign that the company was prepared to diversify its interests, with this relatively small-scale investment into the hotel/casino business being an early pointer as to what would follow on a far greater scale.

1967: Floated On The London Stock Exchange

Credit: jam_90s Flickr

Ladbrokes went public in 1967 with an initial listing of just 50p per share. Anyone who got in early would likely soon have realised they were onto a winner, as the floating of the company on the London Stock Exchange also signaled the beginning of a period of rapid expansion for the firm.

By 1973 the Ladbrokes betting shop empire had grown to 1135 premises, with the company also becoming ever more adventurous with their new acquisitions with new ventures including London-based casinos, real estate, hotels and more.

1972: Acquires London & Leeds Development Corporation

This signified Ladbrokes’ first major move into the real estate market, granting the company property-based interests in the United States in addition to major European cities such as Paris, Amsterdam, and Brussels.

1973: Opens First Hotels of Their Own

Starting on a relatively small scale with just three properties, this soon developed into a successful chain of quality hotels, which no doubt contributed to the company’s future expansion into this sector.

1975: Purchases Lingfield Park

Photo © Richard Croft (cc-by-sa/2.0)

Given the firm’s equine-based origins and subsequent move into real estate, the purchase of the Surrey track seemed a natural fit.

1976: Purchases Seven Greyhound Stadia

Having been supporters of Greyhound Racing through sponsorship since the 1960’s Ladbrokes increased its presence and backing of the sport with the purchase of the tracks at Perry Barr, Brough Park, Crayford and Bexleyheath, Leeds, Gosforth, Willenhall and Monmore.

1979: Casino Scandal

The company certainly felt the benefit of its increasingly diverse portfolio in 1979, when its London-based casino business was dealt a hammer blow.

Found guilty of illegal marketing practices involving the bribing of police officers with the aim of attracting high rollers, all four of the Ladbrokes-owned casinos in the capital were closed, wiping away an estimated 40% of the company’s returns.

1984: Moves into Belgian Market

Ladbrokes purchased Belgian betting shop chain Le Tierce S.A, immediately making itself a major player in the country’s racing and betting industry.

1985: Purchase of Detroit Racecourse

The acquisition of the Michigan venue marked the company’s first major foray into the US racing market.

1986: Dutch Delight

The company had reason to celebrate in 1986 when they were awarded the exclusive rights to open off-track betting shops in the Netherlands.

1986: Texas Homecare Added to the Portfolio

Yet another string was added to the bow with purchase of this DIY store operator.

1986: Formation of SIS

In partnership with other major UK bookmakers, Ladbrokes helped to form Satellite Information Systems (SIS), a television company with the aim of transmitting horse and greyhound racing into UK Betting shops.

SIS is still running today.

1987: Acquired Hilton International

Having dipped its toe into the hotel industry Ladbrokes took the plunge in 1987, paying £645 million to the Allegis Corporation for 91 Hilton Hotels spread across 44 countries. The deal also gave Ladbrokes the rights to the Hilton Brand outside of the USA.

1988: Purchases The Meadows Racetrack

The addition of this Pittsburgh venue acted to cement the company’s foothold in the USA.

1989: Buys Vernons Pools

The purchase of one of the UK’s biggest football pools betting operators acted to expand the Ladbrokes betting portfolio still further.

1989: Purchases Golden Gate Fields

Not content with the recent purchase of The Meadows, Ladbrokes moved into the San Francisco market with the additional acquisition of this track.1994: Stein Retires – First Company Press Conference

Following 37 years at the helm, Cyril Stein stepped down, with Joe Jackson taking over as chairman and Peter George as Chief Executive. The pair promised to conduct Ladbrokes business in a far more open manner, leading to the company’s first ever press conference in the same year.

The new management hierarchy led to a new focus, with Ladbrokes beginning to concentrate more on the gambling and hotel side of the business. Texas Homecare was sold off, together the majority of the Ladbroke’s property portfolio – with this arm of the company finally closing for good in 1997.

1994: Back in the Casino Game

Credit: Matt Brown Flickr

Having refocussed on gambling, the time was ripe for Ladbrokes to move back into the casino business. Three London clubs were initially purchased from City Clubs Ltd for a total of £50 million.

This was followed by Ladbrokes opening its own casino in the capital; the additional purchase of the Barracuda Club from Stakis International; and further ventures into the Colorado and South African gaming markets.

1997: Snaps Up A. R. Dennis Chain

The purchase of the 114 A.R. Dennis betting shops for £31.3 million took the company’s total in the UK to 1,925 at the time.

1998: Brief Purchase Of Coral

Ladbrokes next purchase of a competitor was on a far grander scale, but unfortunately ran afoul of the Monopolies and Mergers Commission. Having paid Bass Plc £363 million for Coral’s 891 betting shops, Ladbrokes were almost immediately ordered to sell them due to anti-competitiveness laws.

Ladbrokes did retain a total of 59 of these Coral shops in Jersey and Ireland, though, with the rest being sold on to Morgan Grenfell Private Equity for £390 million in 1999.

1999: Purchases Stakis Hotels and Renames Itself The Hilton Group Plc

Having been foiled in one major purchase in the gambling sector, Ladbrokes were more successful with their next hotel venture. Snapping up Stakis Hotels for £1.2 billion, the company gained a further 52 hotels and 22 casinos, with the hotel arm of the firm now accounting for 80% of its assets.

Reflecting this shift towards the hotel sector, the company opted to renames itself as Hilton Group Plc at this time.

1999: European Focus

Having not achieved the desired results in its ventures further afield, Ladbrokes opted to focus its gambling related ventures solely on Europe.

Subsequently, the racetracks and casinos in the USA and bingo and betting operations in South Africa were sold off by 2001.

2000: Casinos Go to Coral

Further restructuring came with the sale of Ladbrokes’ 27 UK based casinos to the Gala Coral Group in the year 2000.

2005: Hotels Back To Hilton

19 years on from its initial £645 million purchase of 91 hotels from Hilton Hotels Corporation, Ladbrokes sold its entire hotel division to that same company for a whopping £3.3 billion.

Following this hotel sell-off the company reverted back to the Ladbrokes Plc branding.

2007: Pools Passed On

Next to go was the Pools business which was sold to Sportech one year after the shedding of the hotels.

2007: Advertising Backlash

Following the relaxation of the UK gambling laws in 2005, it was now permitted for gambling companies to run television advertising campaigns. Ladbrokes adverts containing a number of ex-professional footballers – including the ever popular Chris Kamara – became the first to be complained about to the Advertising Standards Authority (ASA) in 2007.

The complaints of the easily offended were ultimately found to be unwarranted though, with the company being cleared by the ASA, both in 2007. A later case in 2009 wasn’t so fortunate.

2013: Buys Betdaq

Ladbrokes purchases Ireland based betting exchange Betdaq for €30 million.

2013: Launches Mobile Sportsbook App

First version of the Ladbrokes Sportsbook App is launched on the Mobenga platform.

2014: LBapuestas Terminated

Having previously traded in Spain under the LBapuestas brand, Ladbrokes terminate this company and opted instead to create a website in a joint venture with the Spanish company Cirsa.

2014: Going Down Under

Image by OpenClipart-Vectors from Pixabay

Ladbrokes makes a move on the Australian betting market with the purchases of Bookmaker.com.au for £13 million and Betstar for £12 million.

2015: Big Merger Talks Begin

Having initially been thwarted with its purchase of Coral back in 1998, talks aimed at a possible merger began 17 years later. If successful, the merger of Ladbrokes with the Gala Coral Group would create Britain’s biggest bookmaker – made up of over 4,000 betting shops and 30,000+ employees.

2015: Major Website Redesign

This was generally viewed to be a huge success, providing a slick, modern update to the Ladbrokes experience online.

2015: The Grid card launched

Ladbrokes launches “The Grid” loyalty card, enabling customers to qualify for rewards including free bets and non-gambling related special offers, whether they were betting in-shop or online.

2015: Supporting Scottish Football

Ladbrokes agrees to sponsor the Scottish Professional Football League in a deal which eventually comes to an end in the 2019/20 season.

2016: Purchases Gala Coral

The merger then finally did go through in 2016. Not without the Monopolies & Mergers Committee having its say once again though. In order to comply with competition laws, it was necessary for in the region of 350-400 shops to be first sold off.

With Betfred and Stan James stepping in to purchase most of the sell-off shops, the merger finally concluded on 2nd November 2016 – the new company going under the name of Ladbrokes Coral Group plc. Whilst essentially a single major company, both the Ladbrokes and Coral brand names were maintained and both run separately on the high street and online.

2017: Sponsors Newbury Showpiece

Following the end of the longest running race sponsorship arrangement in the game, Ladbrokes stepped in to back the race formerly known as the Hennessey Cognac Gold Cup, with the contest being retitled as the Ladbrokes Trophy.

2018: GVC Takeover

March 2018 saw the Ladbrokes Coral Group become the latest company to fall under the umbrella of the global gaming giant GVC Holdings. Already owning the likes of bwin, sportingbet, partypoker and many more, GVC Holdings added the newly merged company to its portfolio in a deal reportedly worth up to £4 billion.

2018: Ominichannel with Playtech

March 2018 proved to be a big month for Ladbrokes – now Ladbrokes Coral – with the company achieving its omnichannel goals through an endeavour with software provider, Playtech, enabling single account functionality across retail, mobile, and online.

2018: £1 Million Compensation.

Ladbrokes runs into trouble with problem gambling. Reportedly paying up to £1 million in compensation to those affected by a reckless individual who used business funds to fund his addiction.

2018: Darts Sponsorship

Ladbrokes announces a four-year deal for the sponsorship of a number Professional Darts Corporation events.

2019: Big Fine

Worse was to follow in 2019, with the company being fined £5.9 million for past failings with regards to anti-money laundering and social responsibility.

2019: Sponsors King George

It wasn’t all negative for Ladbrokes in 2019, with the company further advertising its support for horse racing with the sponsorship of the highly prestigious King George VI Chase at Kempton.